RIM Graduation Model

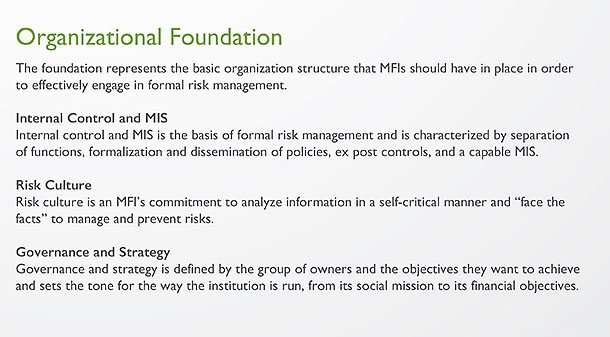

The RIM Graduation Model is a pathways-based, best practice standard for risk management in the microfinance sector. Through a diagnostic process, MFIs can assess their current risk management systems, structures, and capabilities against the RIM Graduation Model and determine their adherence to best practice risk management standards applicable to their institutional tier level. Through assessing their adherence to best practice risk management standards, MFIs are then able to determine their RIM Graduation Path – a strategic improvement pathway which would bring their risk management practices in line with the RIM Graduation Model guidelines.

Why a Graduation Model?

Through consolidating decades worth of experience in providing technical assistance and capacity building activities as well as implementing risk management technical projects, RIM Founding Members have identified a number of contributing factors as to why a the RIM Graduation Model is needed within the microfinance sector.

- Lack of Suitable Risk Management Standards for MFIs at Varying Tier Levels: Currently, barriers and inefficiencies exist which deter MFIs from engaging in risk management. Lack of suitable risk management standards for MFIs at varying tier levels result in financial and psychological barriers whereby MFI practitioners choose not to engage in risk management due to the inability to effectively evaluate the risk management needs of an institution against that of an international benchmark. Similarly, financial inefficiencies are created through spending unnecessary institutional and donor resources than necessary on risk management approaches and technical services which may not be suitable for the MFI at that point in time. Financial and psychological barriers can be lowered and financial resources saved through the use of the RIM Graduation Model.

- Value of Risk Management Misunderstood by Many Microfinance Practitioners: Given the lack of suitable risk management standards for various tier levels of MFIs, the true value of properly-conducted risk management is often misunderstood by practitioners engaged in its implementation. This lack of value translates into an unwillingness to prioritize and invest in risk management activities and often an internal lack of seriousness given to the function vis-à-vis other functions within an MFI.

- Existing Risk Management Frameworks Lack Coherent Link to Double-Bottom Line Mission of Microfinance: Within existing microfinance risk management frameworks, risk is often measured and defined in financial terms – reflecting risk management frameworks traditionally handed down from the commercial banking sector – or captured within definitions of strategic or reputational risk rather than within the fundamentals of the framework itself. The RIM Graduation Model brings double bottom line microfinance back into the forefront through re-framing risk terminology to encapsulate the social elements of the microfinance business model.

- Lack of a Suitable Pathway to Basel Compliance: As compliance to the Consultative Document titled “Microfinance activities and the Core Principles for Effective Banking” as published by the Basel Committee for Banking Supervision (BCBS) in 2010 is being promoted within microfinance regulatory authorities, a sizable gap exists between MFIs’ current operational realities (regulation, country and institutional infrastructure, incentive structures, and risk management skill-sets and appreciation) and their ability to operationalize outlined BCBS guidelines (including navigating the allowed flexibility within these guidelines). There is currently no suitable development pathway for an MFI to move away from current risk management practices and towards that of Basel compliance.

User Benefits

With proper adherence to the RIM Graduation Model standards, an MFI may experience the following benefits:

- Cost-savings through focused, more efficient, allocation of resources towards the risk management function

- Achieving transparency of your institution’s risk management graduation pathway

- Alignment to a global risk management benchmark

- Ability to proactively plan for risk management capacity requirements

- Greater continuity in risk management capacity building due to internationally-accepted risk management framework

- Clear communication to stakeholders about level of seriousness given to internal risk management priorities

- An improved institutional risk profile as viewed by potential investors and regulators

Implement the Framework

MFIs which have participated in the Risk Management Graduation Model piloting include:

- AB Bank Zambia (Zambia – Bank)

- Association des Caisses de Financement à la Base – ACFB (Benin – NGO)

- Banco D-MIRO (Ecuador – Bank)

- Ceape-Ma (Brazil – NGO)

- Dakahlya Businessmen’ Association for Community Development – DBACD (Egypt – NGO)

- Development Action for Mobilization and Emancipation – DAMEN (Pakistan – NGO)

- Edpyme Alternativa (Peru – NBFI)

- Farm Credit Armenia (Armenia – NBFI)

- First Microfinance Bank – FMFB (Afghanistan – Bank)

- GM Bank (Philippines – Bank)

- Jardín Azuayo (Ecuador – Credit Union)

- Microfund for Women (Jordan – NBFI)

- Thaneakea Phum (Cambodia) – TPC (Cambodia – NBFI)

- UGAFODE (Uganda – NBFI)

- Vitas (Romania – NBFI)

MFIs which have conducted full Risk Management Graduation Model Assessments include:

- Hofokam (Uganda – NBFI)

- UNTU Microfinance (Zimbabwe – NBFI)

If you are interested in implementing the Risk Management Graduation Model within your institution or network, please contact RIM’s Director, Kristin Lucas.

–

RIM Graduation Model Assessment Tool How-To Video

Technical Document Downloads (Publicly Available)